So, you’re looking to start investing in HMOs but you need the low-down, right?

Unfortunately, there is no get rich quick secret with HMOs. Like other forms of property investment, they can occupy a large chunk of your time and if you’re not careful, can cost you more money than it’s worth.

So, what does a good investment look like and more importantly, how do you get off to a good start?

This blog isn’t a recipe for success. There is no crystal clear, one size fits all solution when it comes to investment, but hopefully you walk away from this blog with a few tricks up your sleeve that might just help you hit the ground running.

So without further ado, let’s dive into the world of HMOs.

What is a HMO?

A HMO (or a house in multiple occupation) is a property that, by government standards, has 3 or more tenants in forming more than one household. Typical forms of HMOs consist of…

- Refuges, hostels & other types of emergency accomodation.

- Shared houses or or lodgings.

- Buildings containing separate apartments that are not self contained.

- Student accomodation, like halls of residence.

- Employee accomodation.

Is a HMO a good investment?

To answer this in short, yes.

Investing in a HMO is (more often than not) a better alternative than putting money behind single lets. Let me explain why…

Yields are better.

Yields from a HMO are twice as high as traditional buy to let investments.

Existing space can be used to gain maximum returns. Instead of 1 family living in the property, you can have 3, 4 or 5 tenants living in the same space with shared commodities such as bathroom facilities, kitchens and so forth.

Rental voids have less impact.

Traditional buy-to-let properties suffer greatly from rental voids whenever they happen.

Let’s say you have a family of 5 in your property as it stands and they decide to move out. You’re left trying to plug a relatively large gap in your margins and ultimately, you’re at a loss until you find someone else to occupy that property.

With a HMO, if one tenant moves out of a property with 5 rooms, that’s a fifth of your rental income (assuming the rents are equal) from that single property you’re going to miss out on rather than the whole lot.

They're in demand.

Rooms within high-quality HMOs are sought after.

Why wouldn’t they be? They’re cheaper to rent than an apartment or house (which is super helpful especially during the current economic climate), and if you don’t need the extra space, it’s a great solution.

The Shortfalls of HMO Investment

With any investment, there are shortfalls you need to be made aware of. We recommend doing the utmost research around HMOs before you dive in head first only to find out that it’s not for you.

They can be harder to manage.

More tenants means more red tape and time spent managing your HMO. It’s important that you, as a property investor, build a foundation to make this task as easy as it could possibly be.

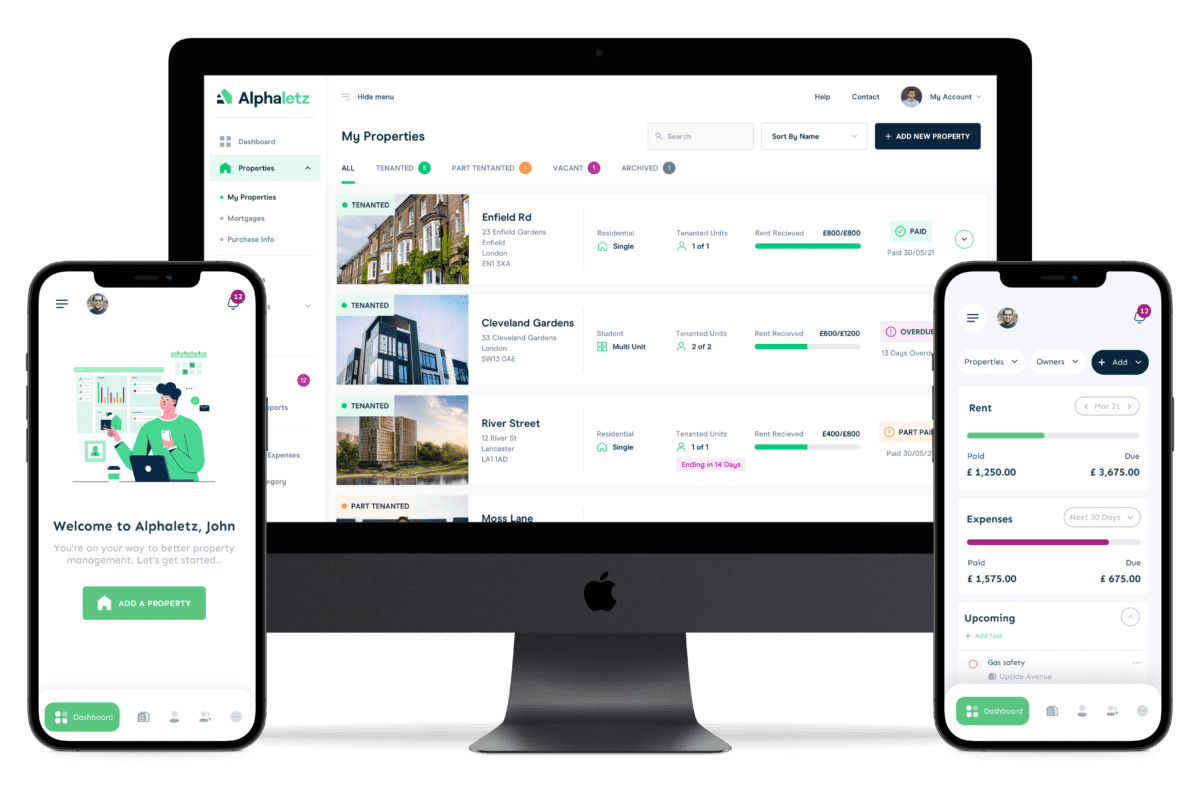

If you’re an existing HMO Landlord/lady or you’re considering getting stuck in, we recommend you start off with the right tools.

Alphaletz has everything a property professional needs to successfully manage their investments.

Try Alphaletz free today or visit one of our on-demand product demos to learn more about LandlordZONE’s official technology platform partner, Alphaletz.

Property Management Software Made Super Simple.

Thousands of property professionals across the globe are making the switch to Alphaletz.

They can be more expensive to get going.

In comparison to traditional buy-to-let properties, HMOs require more investment to get started. This is due to a number of factors, such as:

- Fire safety & security needs.

- Furnishing needs.

- Refurbishment or changes in accordance to legislation to existing communal areas.

You might need specific licensing.

It’s worth checking that your local authority doesn’t require a specific type of licensing before you decide to invest.

It’s important to note that running an unlicensed HMO could lead to heavy sanctions and civil penalties of up to £30,000.

Subscribe to our Newsletter

Get the latest property news, tips, tricks and advice straight to your inbox for absolutely free.