What to tell the insurance company

Firstly, you must make it clear to the insurer that the property is going to be rented out, as most regular household insurance policies won’t cover you.

It’s also important to note that if you make any changes to the property, such as converting a loft or adding an extension, you should inform your insurer, as this may also affect your cover and premiums.

If you fail to inform your insurer of any changes to the property or provide them with inaccurate information, your insurance policy may be invalidated, leaving you without cover in the event of a claim.

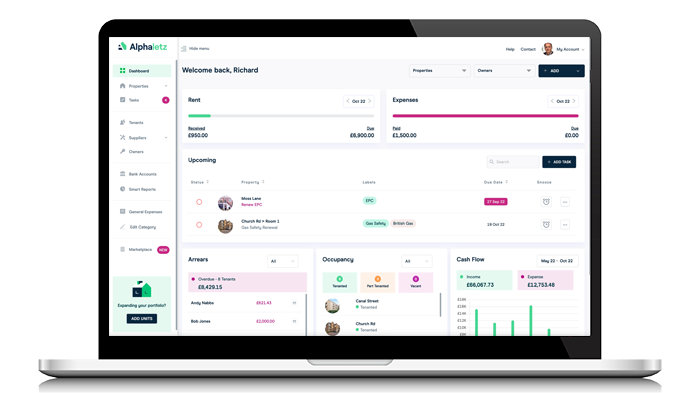

We recommend keeping all your notes, conversations and insurance documents stored safely in a Property Management Software product so you have the information at hand when needed.

Types of Tenant Insurance Cover

It’s important to note that not all insurance policies will cover all types of tenants, and some may have exclusions for certain tenant types. Landlords should check their policy carefully.

For example, some policies may exclude cover for tenants on housing benefit or local housing allowance, students, or for properties let as houses in multiple occupation, so make sure you have the right cover.

Additionally, some policies may not provide cover for lettings to asylum seekers or local authority referrals, as insurance companies may perceive these tenants to be higher risk.

However, it’s worth noting that cover is usually available for these tenant types, although landlords may need to pay a higher premium or inform their insurance company or broker about them.

It’s always important to read the policy wording carefully and check any exclusions or limitations on cover, and if in doubt, speak to your insurance company or broker to ensure that you have the right level of cover for your specific circumstances

Exclusions

In addition to the exclusions mentioned, standard policies usually cover damage to the building itself, as well as fixtures and fittings, caused by events such as fire, flood, storm, theft, and malicious damage by tenants.

The policy may also cover loss of rent due to damage to the property, and alternative accommodation costs for tenants in the event that the property becomes uninhabitable.

Liability cover is also usually included, protecting you as the landlord against claims made by tenants or members of the public for injury or damage to property caused by the property itself or your actions as the landlord.

When a property is let furnished, the landlord needs to ensure that the contents of the property are also covered by the insurance policy. Contents insurance covers the landlord’s furniture, appliances, and other belongings that are provided for the tenant’s use. This type of insurance can be more expensive than buildings insurance because of the higher risk of damage to the contents of the property.

Malicious damage by tenants is often excluded from standard landlord insurance policies, as it is considered to be a higher risk. If coverage is provided, there will normally be a higher excess or deductible. The excess is the amount the landlord is responsible for paying towards any claim, with the insurer covering the rest of the costs.

Unoccupied Properties

Insurance companies often have restrictions on coverage for unoccupied properties, as there is a higher risk of damage or theft when there are no occupants present.

Specialist landlord policies typically provide cover for up to 90 days between lets, but if you need longer coverage, you can speak to your insurer or broker to arrange this.

It’s important to note that if your property is unoccupied due to building works, it’s a good idea to confirm with your insurer that your cover will continue during this period.

They can also cover insurance for other types of rental properties such as Serviced Accommodation or AirBnB short term lets.

Should tenants take out insurance?

Temporary re-housing for tenants may be covered by the landlord’s insurance policy, but tenants can also take out their own insurance policy to cover their personal belongings, liability, and additional expenses if they are forced to move out due to damage to the property.

It’s always a good idea for tenants to consider taking out their own insurance policy to protect themselves and their belongings in case of any unforeseen events

Liability insurance?

Liability insurance cover is an important aspect of a landlord’s insurance policy, and it’s essential to have both property owners liability and employers liability cover. Property owners liability covers claims for loss and personal injury suffered by tenants and visitors to the property, while employers liability cover is necessary if a landlord has employees or engages labour-only workers to do work on their properties, such as a regular tradesperson who doesn’t usually provide materials but does regular repair work for example.

The minimum cover required by law for employers liability insurance is £5,000,000. If a landlord doesn’t have this cover, they could be vulnerable to civil claims for damages, and non-provision of employers’ liability insurance is a criminal offense.

It’s important for landlords to understand that they can be held liable for the actions of their employees while they are working on their property, including any damage or injury caused to others. This is why it’s important to have employers’ liability insurance, which will cover the costs of any claims made against you as the employer. It’s always best to speak to your insurer or broker to ensure you have the appropriate cover for your specific situation.

Don't under insure!

Insuring your property for the proper value is crucial to ensure that you are adequately covered in the event of a claim. If you undervalue the property and there is a claim, the insurance company may pro-rata your claim down and not even cover the full value of the policy, so you only get a proportion of your claim paid on the basis that you only covered a proportion of the value of the property!

Additional Insurance

Landlords may also opt for additional insurance coverage such as legal expenses insurance and rent guarantee insurance. Legal expenses insurance covers the cost of legal fees relating to the tenancy, particularly for claims for possession.

Rent guarantee insurance, on the other hand, covers rent payments in the event of the tenant’s failure to pay and is surprisingly low cost, policies start at around £15 per month.. This coverage is usually subject to the tenant’s approval by a professional reference company, and landlords must comply fully with the policy’s terms, such as submitting claims within a specified time period and making regular rental demands. A good software system can automatically chase the rents for you via email, so you have the full audit trail.

Rent guarantee insurance is surprisingly low cost and a good policy will cover your legal fees too, up to around £100,000.

It’s often overlooked by landlords but in our opinion it’s one of the most important policies to have. Rent arrears normally cause the most amount of stress to any landlord and can run into thousands of pounds and many hours of administration and court time.

Summary

All of the above points about insurance are key points to know as a professional landlord. Having the right software system in place to keep on top of your property portfolio is now more important than ever. A good system will send you reminders and store all your documents securely so you have access from anywhere whenever you may need them. It will also have links to an online marketplace to help you find the right products and services for your property requirements.

Make sure you choose a specialist insurer like Alan Boswell Insurance for your rental properties, and go through our list above to ensure that you are covered for every aspect of your business.