As we’re already aware – Making Tax Digital was originally announced for April 2023…

Then it was delayed until 2024, and we weren’t surprised.

However, the government recently announced that the plans to digitise income tax for Landlords has been further postponed until April 2026, to give Landlords & HMRC alike time to properly prepare.

What is Making Tax Digital?

Making Tax Digital (or MTD for short) is a government initiative designed to digitise tax for Landlords & Property Businesses, reducing the potential for errors and to simplify tax record keeping.

Essentially, the introduction of MTD will be an alternative to self assessments which, depending on how you’re currently doing it, could simplify or complicate things.

Under Making Tax Digital 2026, Landlords will be required to…

- Store records digitally of rental expenses & income. This might mean using an app or another digital alternative that complies with government standards.

- Submit their tax returns online.

- File tax records on a quarterly basis as opposed to once a year.

What else should I know?

It’s been officially declared that from April 2026, Landlords making more than £50,000 will be required to comply with Making Tax Digital regulations.

Alternatively, if you’re earning between £30,000 to £50,000 the date is slightly different, giving you an even bigger window of time. You’ll be expected to comply with MTD from April 2027.

Reviews into the needs of smaller businesses (especially those under the £30,000 threshold) have begun to properly identify how Making Tax Digital can work to the advantage of those who need it the most.

For some, forcing yourself to become compliant for future changes can add to a growing list of problems.

I'm looking for software - what do I need to check against?

If you’re looking for apps or software to be ready for MTD 2026, you’ll want to make sure…

- It can record and store information safely & securely.

- Be easily used & accessed by yourself or your team.

- It’s cloud based.

And finally…

- It isn’t a Spreadsheet!

Spreadsheets can be easily corrupted, lost or even overwritten. When Making Tax Digital kicks in, you’ll want to make sure that none of these dangers are even a remote possibility.

This is why we recommend looking into a system or software that is stored in the cloud, isn’t prone to security breaches & is user friendly.

Making Tax Digital Software for Landlords

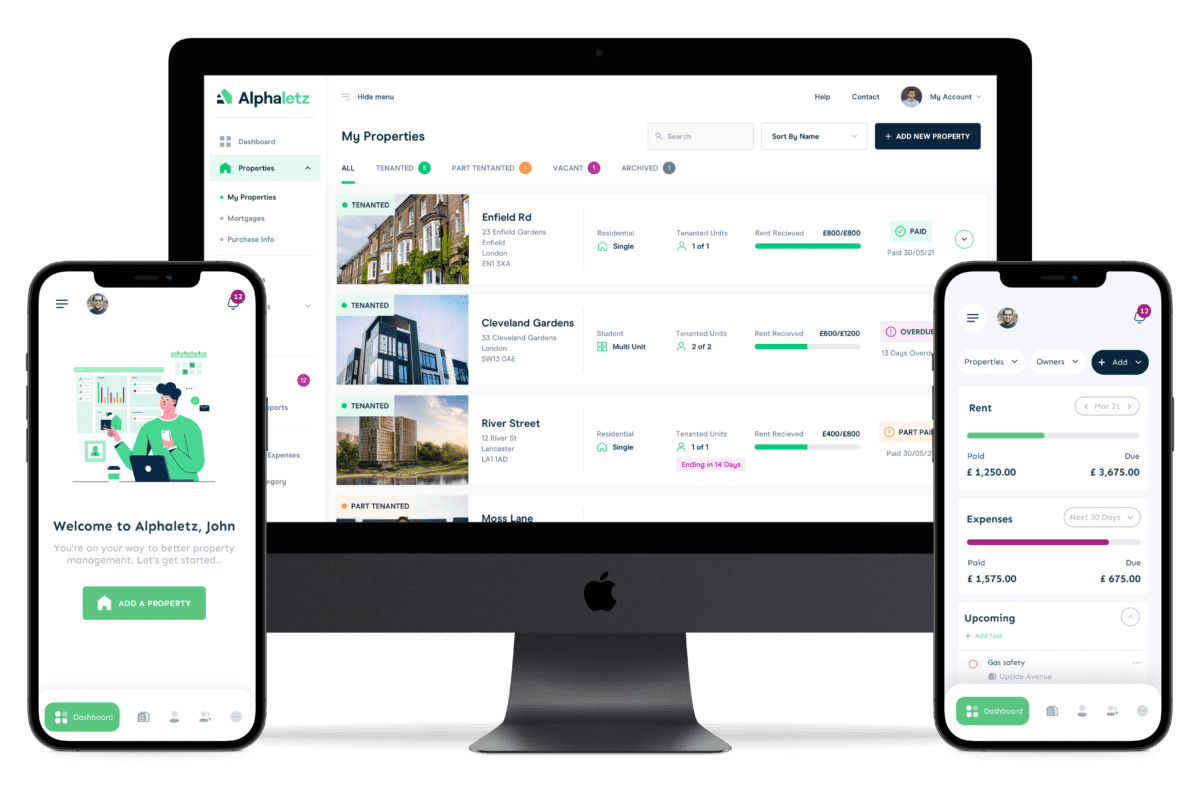

Alphaletz (LandlordZONE’s Official Technology Partner) is a leading Property Management Software used globally by Landlords of every shape and size.

Whether you’re a Landlord with 1 or 100 properties, or whether you specialise in HMOs, AirBnBs or Commercial Property… Alphaletz is the tool you need to truly transform your property business.

Stored Securely In The Cloud

Everything you do on Alphaletz is stored securely in the cloud and encrypted, so your data is safe as houses!

Free Mobile App

We even have a mobile app that syncs up with everything you do on your computer, so you can access your Portfolio on the Go!

User Friendly

Designed by Landlords, for Landlords. Alphaletz has been built to be easy on the eye and extremely simple to figure out, making it the perfect digital solution.

Designed To Make Life Easy

Packed full of features that Landlords love, Alphaletz can help save drastic amounts of time & money on every area of your property business.

Try Alphaletz Free Today!

Thousands of property professionals across the globe are making the switch to Alphaletz.