Tax surrounding property management can be complicated. This is especially true when new taxes are introduced and come into effect slowly over the years. One such tax, known as Section 24, was announced in 2015.

If you’re a new landlord just putting a property portfolio together, you’ll need to research the tax laws surrounding your acquisition of new real estate. In the case of Section 24, it’s best to get a good head start.

So, the Section 24 property tax has changed the real estate landscape in several ways, but what does it mean for you? Check out our guide below if you want to know more about what it means for your property portfolio.

What is Section 24 Property Tax?

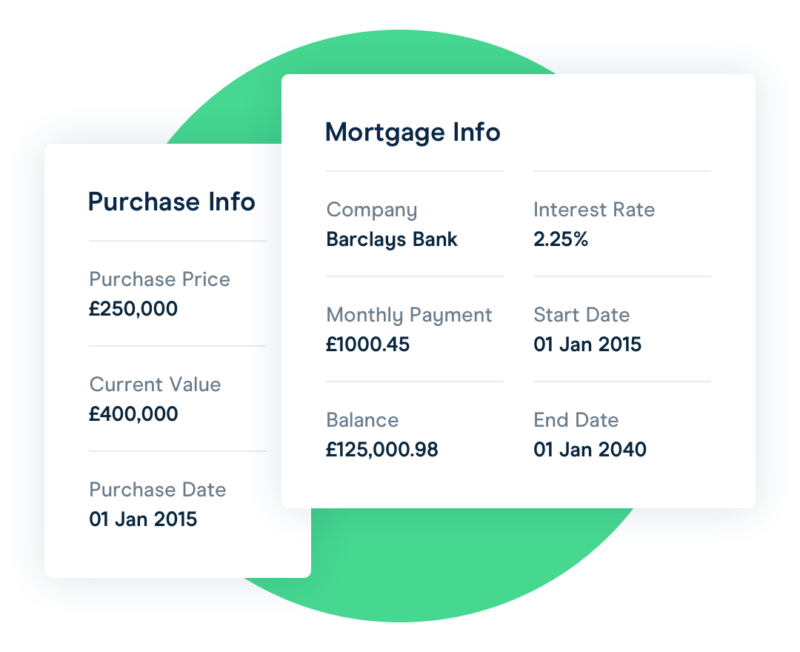

If you’re still asking yourself, “What is Section 24 property tax?” we can help. Section 24 is a relatively new tax on buy-to-let mortgage relief, stating that landlords can no longer deduct interest on their mortgages from their overall income. The Section 24 tax first came into effect in April 2017, beginning in the new tax year.

Before the tax was introduced, landlords could claim tax relief on any residential properties they were currently paying mortgages on. These costs could also cover various other loans relating to the rental properties on their portfolio. If you’re a landlord, don’t be disheartened by this tax law. Whilst you’re no longer able to deduct interest from a tax bill immediately, you can still claim back the cost of interest up to 20%.

Why Was the Tax Introduced?

The government introduced the tax intending to hit multiple goals. Most of all, they plan to curb the potentially endless value in the rental market, specifically in the private sector. With this new tax law active, landlords could no longer claim the full cost of loans back on their expenses.

This tax also encourages more first-time buyers into the real estate market. If career landlords no longer had such a strong incentive to swallow up properties, there was a better guarantee that affordable housing would be available in great numbers. All in all, it’s been used to help level the playing field in the housing market.

What Changes Will Landlords See?

If you own a property outright, it’s unlikely you’ll see much change. However, if you’re paying mortgages on properties and still have a lengthy term to go, no longer will you be able to claim these interest payments back in full. You’ll only be able to claim up to the basic tax rate, which is 20%.

You’ll also need to pay these taxes upfront. If you’ve been a landlord since before 2015, and more specifically before 2017, this can be quite the change in process for you. However, for anyone looking just now to start a property portfolio, this will be the usual way of paying tax on your rental properties.

Who Does the Section 24 Tax Affect?

Section 24 doesn’t affect all landlords in the UK. If you’re a private landlord in the lower tax band, you won’t have to worry about being affected until you’ve hit the higher tax rate. As your portfolio grows, you’re much more likely to pay under the new Section 24 law.

During the next tax cycle, Section 24 will be in full effect for anyone in the higher rate band. This section will work alongside income tax and any other tax levied against rental properties. Work closely with your accountant and property manager or use specialised software to ensure you calculate the rental tax you need to pay accurately.

How Does Section 24 Property Tax Work?

With Section 24 enforced, you’ll need to pay tax on all the rental income you receive. You can then claim back mortgage interest costs but only up to 20% (the basic rate of income tax).

In effect, it means landlords now pay more tax upfront. Plus, if you also receive a salary from another job, this could bump you into the next tax band which can increase the amount of tax you pay overall.

Here’s an illustration of how Section 24 works:

- Your rental income is £15,000.

- Your mortgage interest is £5,000.

- Under Section 24 you’ll need to pay tax on the full rental income. This is £3,000 for basic rate taxpayers (20%) and £6,000 for higher rate taxpayers (40%).

- You can then claim back 20% of your mortgage interest payments which is £1,000 (20% of £5,000).

- Therefore, basic rate taxpayers will pay £2,000 tax on their rental income and higher rate taxpayers will pay £5,000.

For lower income earners, the effect will be minimal. For landlords with large portfolios, the impact could be significant especially as mortgage interest rates rise.

Could a Landlord Manage or Offset Section 24?

Many landlords are now looking for buy-to-let mortgage tax relief, with many choosing to slim down their portfolios to avoid being taxed at the higher rate. You could also choose to raise the rent for your tenants to help cover these increased costs, but this could make you an unpopular landlord. It could also push you further up the tax bracket.

Another significant Section 24 tax loophole is that it only affects residential properties. If you choose to let only to commercial tenants from now on, you won’t have to pay the increased tax.

Moving your properties into a Limited Company

Your other option is move your properties into a Ltd company or other similar structure. This can be very expensive to do, but once done, all mortgage interest can then be offset again and it could save you a fortune in the long run.

There are many other advantages of a Ltd company structure, such as being able to set up an interest free loan to minimise other taxes, and make higher pension contributions into your SIPP. You will need to take specialist advice for your own situation and we recommend Property118 who we have used ourselves.

The downside is that limited companies are subject to capital gains tax and corporation tax, so you’ll need to weigh up the sums involved which is why it’s more generally suited to landlords who are higher rate taxpayers or who own bigger portfolios.

Alphaletz is Here to Help Landlords Like You

Dealing with a new tax can be scary when you have a full portfolio to manage. Here at Alphaletz, we want to make that easier. Our property management software can help bridge the gap between the rental profit you make and the tax forms you must submit.

We also have a great pool of resources that you can find on our website and in the Alphaletz Marketplace.

Award Winning Property

Management Software

The #1 property management software for Landlords & Property Managers, as featured by the NRLA.

Everything you need to know about this new tax will be in one place, including income records and expenses according to any financial period you wish to see. And it’s not just the Section 24 tax we can help you with. Our desktop and mobile app allows you access to your whole data bank for any tax issues you need to oversee. If you manage properties for other people such as family members or other landlords, or in a Ltd company or personal names, you can do this too all from one account in the Alphaletz system.

Our Finance and Reporting service has supported landlords just like you in the past. Get in touch with our team to find out more about what our software can do for the financial side of your business, or simply book a demo and see for yourself.