As a property investor, you’re probably looking at the market and wondering what just happened!

There you were, enjoying super low interest rates, nice steady house inflation and good rental demand, then ‘Pow’…

Interest rates suddenly went up to around 6% for a fixed rate mortgage (as of October 2022) and sent anyone with a variable rate mortgage into panic mode, as landlords scramble to lock in before rates go even higher.

Before this new hike in rates, even with all the new regulation and legislation, being a landlord was still worth the hassle because property prices were still going up and interest rates were low, so the increased costs could be absorbed by the extremely low borrowing costs.

But things are changing...

Landlords are worried that increasing rates will lead to a decline in property prices and there is also talk of even more legislation such as changes in EPC regulations and the prospect of rent freezes and even eviction bans.

This is sending many investors into a wild panic.

Landlords are issuing Section 21 notices to get tenants out so they can sell up, or they are raising rents to help offset the new costs which is causing friction with tenants, who are also feeling the pressure of increased energy costs and rising inflation.

There is also a proposal in parliament to abolish Section 21, meaning that Landlords won’t just be able to give 2 months’ notice to a tenant to vacate, creating yet another hurdle for landlords to jump over if they want their property back.

However, before everyone panics too much, let’s try and look at all the data.

It appears that smaller landlords with one or two properties are being hit the hardest.

This is because they are almost certainly in a full-time job and property was always seen as a long-term investment for them, such a ‘pension pot’ or they became accidental landlords when their circumstances changed.

So, with the introduction of Section 24 which means that they can no longer offset their mortgage interest against rental income, they may well be making a loss, and in some cases even being pushed into a higher rate tax bracket which will impact their main income too.

On the flipside.

Professional landlords with bigger portfolios who are running their properties as a business, are seeing big opportunities ahead. But why?

Firstly, bigger landlords will have well organised property management systems in place, they have almost certainly been building their portfolios for several years and many will have gone through similar turmoil in the past.

This doesn’t mean they are bullet proof, but it does mean they think of their investments as a business, just like any other business owner who is trying to navigate the current economic waters.

They are seeing a downturn as an opportunity, rather than a threat, with an opportunity to acquire more properties at a more affordable rate.

Let's start with the numbers...

Did you know that in 1918, over 75% of people in England and Wales rented their homes? Things changed in the late 20th century, peaking at 70% home ownership in the early 2000’s.

As of July 2022, the UK Average House Price was £292,118 according to the HM Land Registry, a rise of 11% over the same period from a year before according to Nationwide.

We are expecting prices to drop in 2023, but of course, nobody knows for sure. The demand is still very high due to the housing shortage, but there will be less people able to get a mortgage if rates continue to rise which may slow the market down.

When the financial crisis of 2008 hit, many people realised that owning a home wasn’t always the best investment.

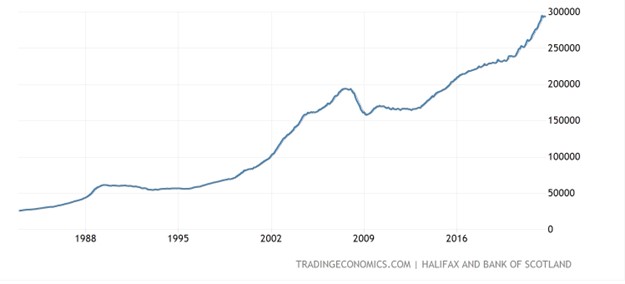

Prices crashed about 15% and it was about 5 years before they fully recovered.

However, at the low of 2009, the average price index was £154,452, so if you had been able to buy property then, based on today’s values, you would have doubled your money, (not accounting for inflation.)

So where are we today?

Well, the facts are that there is still a housing shortage and rental demand is at an all time high.

Rents are up 11% this year, while there are 50% less properties available to rent, resulting in 3 times more tenants than available properties.

According to Rightmove, they are saying that has resulted in the most competitive rental market they have ever recorded.

At Alphaletz, we speak to landlords every day and we are hearing stories of 50+ applications per property and even bidding wars between tenants.

The question is... Where else do you invest?

You could put in the stock market, but the odds are that if the housing market crashes, stocks will follow.

You could put it in the bank, but rates are still lagging behind inflation, or you could even put it in gold and silver, but then you have to store it somewhere safe which also has a cost.

The good news about property is that even if values go down, if you leverage your purchase properly you can still cashflow, allowing you to make a monthly income even in a declining market.

Investments never go up in a straight line, but if you take the average growth rate of property over the last 50 years, the average annual growth rate is surprising 9.3%.

Below is a graph illustrating property values & average prices over the years.

So, what can you do to prepare and benefit from the impending property downturn?

According to Robert Kyosaki, the author of ‘Rich Dad Poor Dad’ he bought $300 million dollars of real estate in the financial crash of 2009.

He got incredible bargains and described the market as a ‘sale’ on buying properties.

Of course, not everyone has access to that sort of funding, but for those that are wondering what to do, ask yourself where you think property prices and rental demand will be like in the next 5 to 10 years.

Demand is only going one way as we continue to deal with a housing shortage and the government certainly can’t cope with the rental demand either.

At Alphaletz, we are portfolio landlords and investors too, and have lived through a few crashes before.

We understand the cycles and are prepared for what lies ahead.

From our own experiences, we believe that there are a few very important things to do right now.

1. Stabilising interest rates.

Fixing interest rates can help, or alternatively consider moving money out of the stock market (while stocks are still relatively high) to pay down debt to reduce your payments.

Ensure that each property is in positive cashflow each month, and you have margin built in for further increased costs.

Keep your credit rating high and ensure you don’t miss any mortgage payments, so you are ready to move fast if you want to increase your borrowing and buy more properties at bargain prices.

2. Secure your rent.

Protect your income with rent guarantee insurance.

This is vital and is still available at an incredibly low price. Just around £160 per year.

We expect these prices to go up, so buy now. The cost of arrears and evicting tenants can cost you thousands and take months to resolve, especially in this market.

3. To incorporate, or to not incorporate...

Look at your property structure, should you incorporate into a Limited company?

Check your options and fully understand the pros and cons for your own circumstances. We can recommend Property118 from using them ourselves.

4. Run your portfolio like a business.

Be professional. Get yourself a great Property Management Software system where you can track everything and remain in full control of your business.

Software has come a long way in the last few years and Alphaletz is purpose built for landlords. As its cloud based, it will also continue to evolve too.

5. Get educated.

Keep up to date with what’s happening as the market changes.

Alphaletz has some great blogs on all sorts of topics from how to raise rents to evicting a tenant. Plus, we would recommend joining LandlordZONE where you can get access to free webinars & materials too.

Subscribe to our Newsletter

Get the latest property news, tips, tricks and advice straight to your inbox for absolutely free.