It’s been a tough old year.

With strict legislation set to be voted on in Parliament (May 2023) many Landlords are anxious and unsure whether their property investments are still going to be worthwhile.

A small number have headed for the exit entirely, leaving behind a higher demand for rental homes throughout the United Kingdom.

So, what’s causing this hectic scramble that’s prompting a minority of Landlords to shut up shop entirely?

In this blog, we’ll be investigating why so many Landlords have called it a day and sold their buy-to-lets.

We’ll also be looking at how you can make life easier should you choose to stay in the private rented sector.

Unfair Legislative Changes

One of the most prominent reasons causing Landlords to shy away from the rental market is past & pending legislative changes.

Over the last few years, Landlords have been barraged by frequent legislative changes that have worked against them.

For example, we’ve previously covered the impending vote on the Renters Reform Bill and the impact it could potentially have within the private rented sector.

'Reform' On The Horizon

The Renters Reform Bill is an unwelcome addition to legislative bombardment that Landlords have previously endured, such as Capital Gains & Dividend cuts.

So not only is there a list as long as your arm of things you now need to tread carefully around, there’s also less profit to work with thanks to rising costs.

With this in mind, there’s no real shock and awe when we discover that there’s been an exodus of Landlords fleeing the PRS, with a 13% increase of Landlords selling up & moving on over the past 4 months.

Rising Interest Rates

Costs are on the rise, and with the announcement of the Mini Budget in 2022, base interest rates saw a sharp increase making buy-to-let mortgages less affordable.

In December 2021, the average two-year buy to let mortgage rate stood at 2.9%. By the beginning of November 2022, this had risen to a monumental 6.75%.

Unsurprisingly, rising interest rates are having a knock on effect on BTL mortgage affordability, slimming the amount of profit Landlords can make from their potential investments.

The Ultimate Dilemma

You might find that if you’re a Landlord, you’re stuck between a hard place and, well, a hard place. Unfortunately, much to your dismay, there’s no magic wand that’s going to fix all of the coming hardships you’ll face.

But you’re not alone. It’s a predicament that the whole private rented sector is feeling.

And we get it. On one hand, your interest rates are rising, margins are narrowing and you’re expected to foot the bill, but for those increasing rents to cope, you run a higher risk of arrears.

On top of that, with the abolishment of Section 21 on the horizon, it could be harder for Landlords to regain possession of their own property.

This is why most Landlords are pulling the trigger now, with fears that they’ll be unable to do so due to the Renters Reform Bill.

Should I be one of the Landlords Selling Up?

With all these hardships in mind, most are wondering if it’s simpler to just sell their property and move on.

And that’s totally your prerogative. However, if you’re willing to hang in there, there’s a few things you can actively use to your advantage to help make your life as a Landlord less troublesome.

Tax Planning

We work with partners like Property118 who are expert advisors when it comes to tax planning which could potentially reveal thousands of pounds worth of savings, all by making simple changes.

Click here to learn more about Property118’s Tax Planning Service

Use The Right Tools

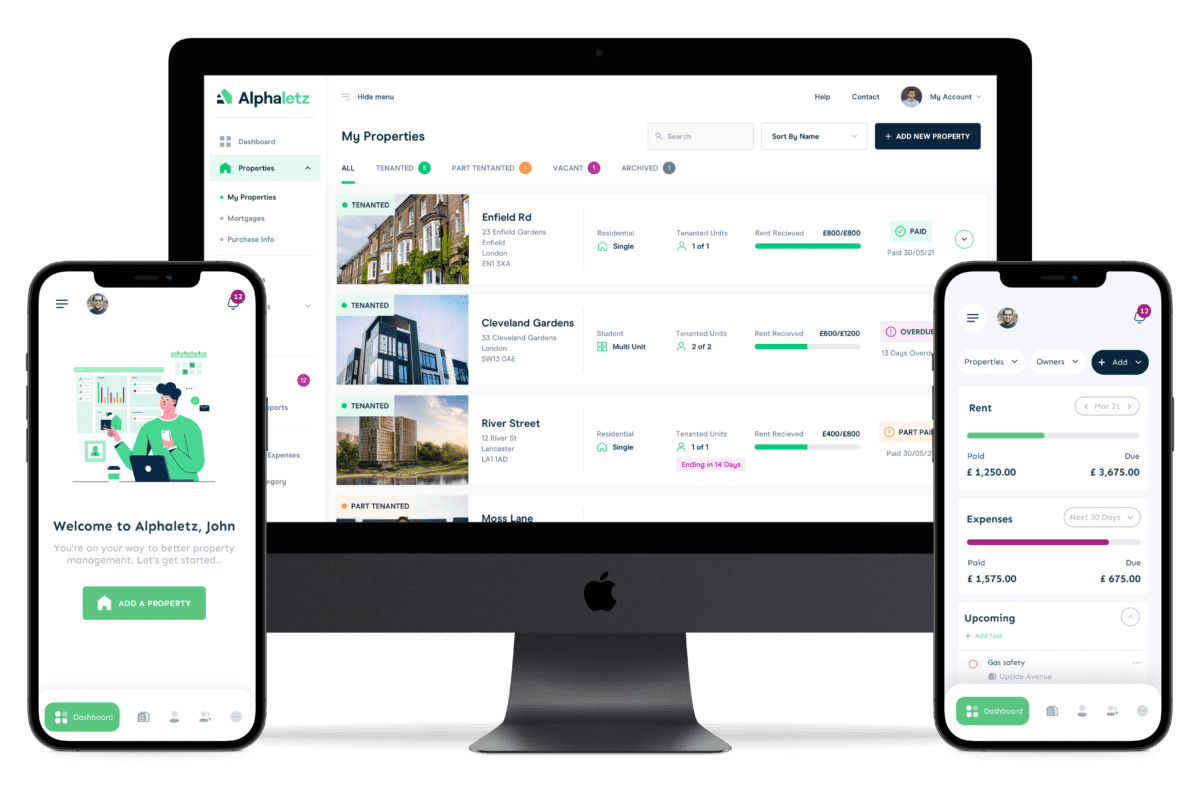

We’ve been on a bit of a mission to help Landlords digitise their property portfolio with Property Management Software.

If you’d like to learn more about Alphaletz & how we can help you save time & money, click here.

Generate Income From Your Properties

Thanks to Alphaletz, you can now passively generate income from your own rental properties whilst simultaneously compiling all of your tenants bills into a single product offering.

Secure Your Rental Income

There’s comfort in knowing you have a failsafe in place in case of your tenant defaulting on rental payments or in other instances occuring such as damage to your property.

Here’s a couple of ways you can safely secure your rental income:

Rent Guarantee Insurance

Rent Guarantee Insurance is an absolute must, especially considering the financial difficulty that a lot of tenant’s could face in the coming years.

There’s no better peace of mind than ensuring your rent payments are met, and with rent guarantee insurance, you can do exactly that.

Click here to learn more about Rent Guarantee Insurance from our partner Alan Boswell.

Using a Guarantor

Currently, a large portion of Landlords rely on guarantors as a fall-back option if their tenants fail to pay rent.

If you’re unsure what a guarantor is, it’s somebody who agrees to pay your tenants rent should they be unable to pay for whatever reason.

Failing this, Landlords can take guarantors to court to recoup the missing rental income.

Automate Your Rent Collection

With services like GoCardless, you can now put your rent collection on autopilot and with great success, too.

With GoCardless, if a payment fails, there will be an automatic attempt to recollect using an intelligent payment system so there’s a greater chance of collecting your rent on time and without having to chase.

Ditch Spreadsheets with Confidence

Join 1000s of Landlords moving away from spreadsheets to Alphaletz and save time & money.